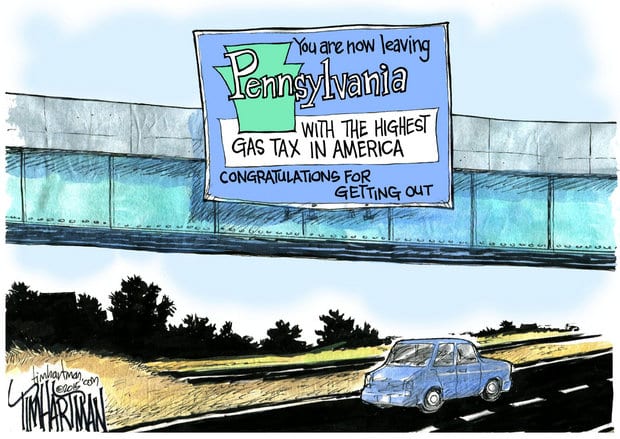

California has the highest number of high-mpg hybrid and electric cars in the nation. And, according to Polk Research, Los Angeles and San Francisco together account for almost one-quarter of all the nation’s EV registrations. That means that we have a lot of cars on the road that aren’t paying into the infrastructure-supporting gas tax like traditional internal combustion-powered cars and trucks do. This inequity has led the state to propose a switch from a gas tax to a road usage tax, where all users would presumably pay by mile instead of by gallon purchased. The logistics of how this would be accomplished aside, there’s a lot to consider with such a switch. First off, it would allow EV and Hybrid car drivers to pay their fair share in support of the roads they are using. As a direct usage tax, it potentially would also allow for more flexibility in practice with not every mile counting the same—congested areas could charge more than less congested roads affecting traffic patterns, pollution, and congestion, much like is done in places like London. The down side to a switch to a road tax is of course that it requires some sort of digital tattler on board, like a FastPass, to actually accrue the miles and set the tax owed. Some people will not like that seeing it as an affront to their freedoms. The other major issue is the chance that the road tax wouldn’t replace the gas tax but would be dumped on top of it as yet another burden on the consumer to pay for government-mandated malarkey. That’s pretty much what happened in London, but at least the commuters there have viable alternatives to driving while in the city. What is the state of affairs where you live, are there rumblings like in California to impose a direct-use tax? Do you already face such a road tax? Death and taxes are supposedly twin ultimatums, when it comes to the latter, where would you rather pay: at the pump or on the road? Image: PennLive

California has the highest number of high-mpg hybrid and electric cars in the nation. And, according to Polk Research, Los Angeles and San Francisco together account for almost one-quarter of all the nation’s EV registrations. That means that we have a lot of cars on the road that aren’t paying into the infrastructure-supporting gas tax like traditional internal combustion-powered cars and trucks do. This inequity has led the state to propose a switch from a gas tax to a road usage tax, where all users would presumably pay by mile instead of by gallon purchased. The logistics of how this would be accomplished aside, there’s a lot to consider with such a switch. First off, it would allow EV and Hybrid car drivers to pay their fair share in support of the roads they are using. As a direct usage tax, it potentially would also allow for more flexibility in practice with not every mile counting the same—congested areas could charge more than less congested roads affecting traffic patterns, pollution, and congestion, much like is done in places like London. The down side to a switch to a road tax is of course that it requires some sort of digital tattler on board, like a FastPass, to actually accrue the miles and set the tax owed. Some people will not like that seeing it as an affront to their freedoms. The other major issue is the chance that the road tax wouldn’t replace the gas tax but would be dumped on top of it as yet another burden on the consumer to pay for government-mandated malarkey. That’s pretty much what happened in London, but at least the commuters there have viable alternatives to driving while in the city. What is the state of affairs where you live, are there rumblings like in California to impose a direct-use tax? Do you already face such a road tax? Death and taxes are supposedly twin ultimatums, when it comes to the latter, where would you rather pay: at the pump or on the road? Image: PennLive

Leave a Reply